From Reaction to Proaction: Why Continuous Compliance Is the Foundation of Stable Organizations

Continuous compliance shifts compliance from reactive to proactive.

Continuous compliance is not just another conference buzzword.

It is a response to a world where cyberattacks, data breaches, and new regulations emerge faster than most companies can update their procedures. In this environment, continuous compliance becomes a core pillar of organizational stability.

At the same time, the cost of mistakes is rising. The average global cost of a data breach is now close to USD 5 million and continues to increase year over year. Add to that regulatory fines, customer churn, and very real operational downtime and the business case becomes painfully clear.

This article explains why continuous compliance should become a pillar of strategy for every mature, responsible organization, and how Quantifier.ai AI agents help shift from “firefighting” to proactive risk and compliance management. After reading, you will:

- understand what continuous compliance looks like in practice and how it differs from the classic approach to compliance,

- learn the scale of today’s threats and regulator expectations,

- see how early-warning mechanisms and intelligent notifications work in Quantifier.ai,

- understand the specific benefits continuous compliance delivers to legal and operational teams.

What Continuous Compliance Looks Like in Practice

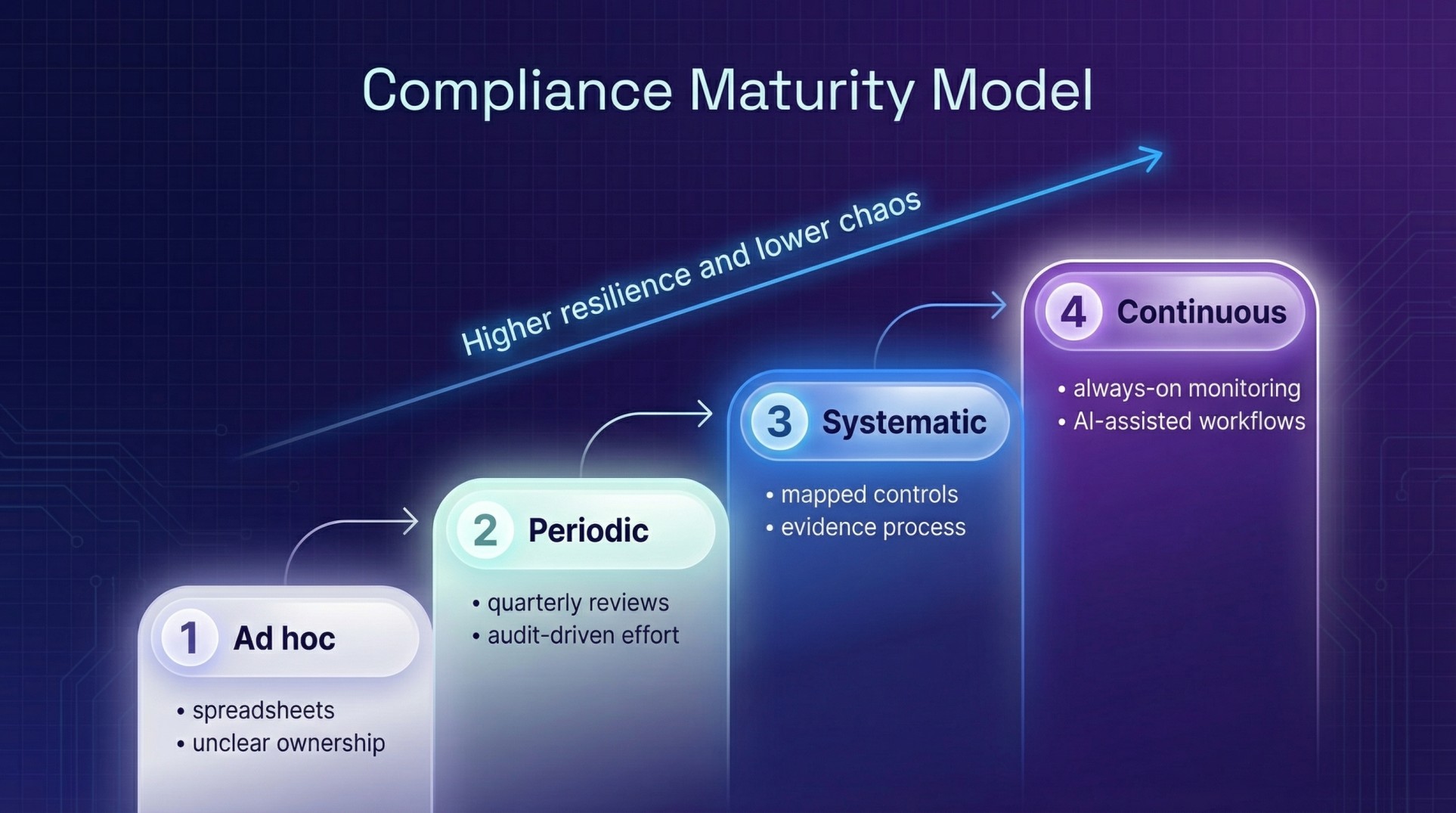

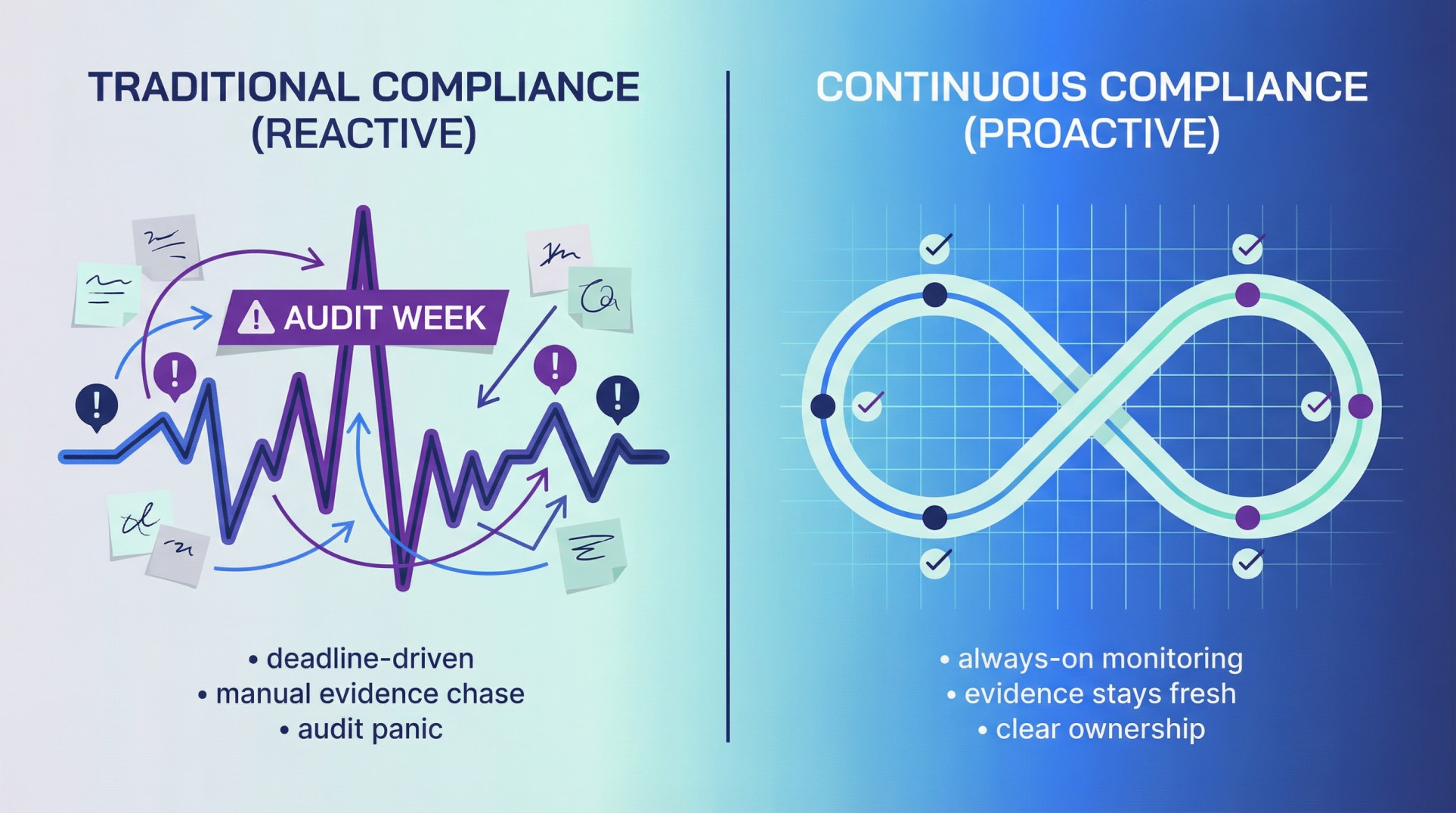

The traditional approach to compliance can be summarized simply: project, deadline, audit, report, forget. Every few or several months, an organization “wakes up” to:

- update policies,

- collect evidence for an audit,

- submit a few late notifications to regulators,

- then return to “normal work.”

Continuous compliance works the other way around. It is not a one-off project, but an ongoing process that stays current with:

- regulatory requirements (e.g., NIS2, ISO 27001, DORA, GDPR),

- real security incidents,

- changes in business processes and systems.

In practice, continuous compliance means:

- Compliance is monitored in real time or near real time.Instead of asking once a year “do we meet the requirements?”, the organization has continuous visibility into gaps, delays, and unassigned tasks.

- Compliance evidence is collected automatically.Instead of a frantic collection of PDFs and screenshots before an audit, evidence becomes a growing set linked to specific requirements and processes.

- Compliance is embedded into operations.Continuous compliance does not live in a separate spreadsheet. It is integrated into the day-to-day work of operations, IT, security, HR, and finance.

- AI and automation support people.Given the scale of modern regulations and frameworks (GDPR, ISO 27001, NIS2, DORA, ESG, the AI Act, etc.), manual tracking is effectively impossible.

Quantifier.ai approaches continuous compliance in an AI-native way. Instead of yet another task list, it provides intelligent agents that understand regulatory requirements, coordinate work, monitor deadlines, and help maintain compliance as a permanent part of daily operations. For this model to work smoothly from day one, expert support is also essential, especially during implementation, process design, report preparation, and organizing data collection and verification.

Growing Threats: Cyberattacks, Data Breaches, and Regulatory Pressure

Continuous compliance is becoming more important because risk is not going away. It is accelerating.

Scale of attacks and incidents

European threat landscape reporting in recent years has highlighted the dominant role of ransomware, DDoS attacks, and data-targeted threats. For companies, this means:

- statistically, a major incident is a matter of time, not “whether it will happen,”

- the impact goes far beyond technology, hitting operational continuity, revenue, and reputation.

Global incident cost data shows that the average cost of a data breach exceeds USD 4.8 million, and attacks spanning multiple environments (on-premises, cloud, vendors) are even more expensive.

Data breaches in the EU and business accountability

At the European level, there is a clear increase in personal data breach notifications. In practice, business responsibility is no longer limited to “keeping the system running.” Organizations must:

- demonstrate that they did everything possible to minimize risk,

- document preventive measures and incident response actions,

- maintain continuous compliance with legal and industry requirements.

Continuous compliance becomes a defensive mechanism here. It helps demonstrate due diligence, reduce the risk of fines, and improve communication with regulators.

Continuous Compliance as the Foundation of Stable Organizations

A stable organization in 2026 is one that handles incidents effectively because it:

- detects them faster,

- prevents them more effectively,

- responds more efficiently,

- can document its actions.

Continuous compliance strengthens stability on multiple levels:

Operational

It enforces process transparency, clear accountability, structured access management, and orderly governance of vendors and data. This translates into lower risk of unexpected downtime and less chaos during crises.

Financial

The cost of building continuous compliance can be lower than the cost of a single major incident or administrative penalty. With average breach costs reaching several million dollars, investing in continuous compliance becomes a classic “pay now or pay much more later” case.

Strategic and reputational

Partners, investors, and customers look not only at financial results but also at maturity in security and compliance. A stable organization with well-functioning continuous compliance is simply more credible.

Regulatory

New regulations such as NIS2 and DORA assume organizations can demonstrate not just one-time compliance, but sustained high levels of cyber resilience and risk management.

Continuous compliance is the mechanism that helps an organization balance innovation and change velocity with legal and market expectations.

From Reaction to Proaction: How Quantifier.ai AI Agents Transform Compliance

The problem with traditional compliance is simple: it is too manual, too slow, and too expensive. Spreadsheets, dozens of document versions, calendar reminders, and “please update” emails do not scale with:

- multiple standards (GDPR, ISO 27001, SOC 2, NIS2, ESG),

- complex organizational structures,

- a growing number of systems and vendors.

Quantifier.ai approaches continuous compliance using AI agents. The AI Agent Officer acts like an always-available compliance assistant, specialized in understanding frameworks and coordinating tasks.

In practice, AI agents:

- map regulatory requirements to specific processes and owners,

- break down complex frameworks into task and evidence lists (e.g., for ISO 27001, NIS2, ESG),

- assign and track accountability across legal, IT, security, HR, and operations,

- monitor work and evidence status in near real time,

- analyze gaps where documentation, processes, or implementation evidence is missing.

In this model, continuous compliance becomes largely an AI-driven coordination problem rather than manual chasing by the compliance team. People step in where interpretation, decisions, or process changes are needed. AI agents handle the rest: collecting data, reminding, escalating, and proposing next steps.

Benefits of Continuous Compliance for Legal and Operational Teams

Continuous compliance with AI agents is most impactful where compliance used to mean:

- manual information gathering,

- chasing people for documents,

- assembling reports at the last minute.

Legal teams

For legal teams, continuous compliance with Quantifier.ai means:

Less administrative workInstead of manually collecting compliance status updates, lawyers have access to a current view of requirements, evidence, and gaps.

Better readiness for inspections and auditsContinuous compliance reports are generated from up-to-date data. It becomes easier to respond to regulators or auditors by showing what the organization actually does daily, not just a policy on paper.

More time for strategyReducing administrative work allows teams to focus on risk analysis, planning implementation of new regulations (e.g., NIS2, DORA, the AI Act), and advising leadership.

Operations and IT

From an operations and IT perspective, continuous compliance:

- clarifies accountability: it is clear who owns which process and requirement,

- reduces communication chaos: tasks do not disappear in email threads, they are assigned in one system,

- provides priority clarity: which requirements affect critical systems security versus those that are less urgent,

- reduces inter-department friction: dependencies between tasks, SLAs, and the impact on organization-wide continuous compliance are visible.

Quantifier.ai also helps connect compliance to business context and governance by presenting requirements within ESG, ISO, or NIS2 frameworks, rather than as an abstract checklist.

Practical Applications of Continuous Compliance with Quantifier.ai AI Agents

How do you implement continuous compliance in practice using AI agents?

1) Mapping requirements and frameworks

The first step is importing and assigning the relevant frameworks:

- regulatory (NIS2, DORA, GDPR),

- industry (ISO 27001, SOC 2),

- internal policies and standards.

Quantifier.ai maps these requirements to real processes, systems, and teams, creating a foundation for continuous compliance, not a one-time implementation sprint.

2) Assigning accountability and configuring agents

Next, define who is responsible for which areas and what actions should be monitored. Quantifier.ai AI agents can:

- assign tasks to process owners,

- set deadlines and SLAs,

- define escalation rules for critically overdue tasks.

The result is a distributed but coherent process where everyone knows what they own.

3) Automated evidence collection and monitoring

Then integrate the system with key data sources (security systems, ticketing, logs, document repositories). AI agents can automatically:

- attach evidence to the appropriate requirements,

- check whether evidence is outdated,

- remind teams about periodic reviews.

Continuous compliance means evidence stays current continuously, not just for the audit.

4) Dashboards, alerts, and reports

At the governance level, continuous compliance becomes tangible through:

- dashboards showing compliance status for specific regulations,

- alerts about gaps and risks,

- reports for executives, risk committees, and supervisory boards.

AI agents can also generate recommendations: where to strengthen a process, which tasks to accelerate, and which areas are most exposed to risk.

In all of these areas, AI agents support rather than replace people. Their role is to keep continuous compliance moving so teams can focus on decisions, not manual handoffs.

The Future of Continuous Compliance

The future of compliance in Europe is clear in one respect: there will be more regulations, and requirements will become more complex.

This means continuous compliance must cover not only information security and data protection, but also:

- responsible AI use,

- vendor and supply chain governance,

- linking tech regulations with ESG and governance.

In this world, manual compliance management will become not only inefficient, but simply impossible. The future of continuous compliance is:

- agent-based AI platforms capable of integrating multiple regulations and frameworks,

- continuous risk analytics in near real time,

- strong links between compliance and business decisions (e.g., risk assessment when entering a new market or launching a new product).

Summary

Continuous compliance is not another “compliance project” you can tick off. It is a comprehensive operating model that:

- reduces the costs and impact of incidents,

- lowers the risk of fines and disputes with regulators,

- improves operational stability,

- strengthens trust among customers, partners, and investors.

Quantifier.ai helps organizations move from reactive, manual compliance to proactive, automated continuous compliance. With early-warning mechanisms, intelligent notifications, and automated evidence collection, organizations can finally stop putting out fires and start managing risk and growth deliberately.